Legal Update – 10 January 2026

2025 Tax Review

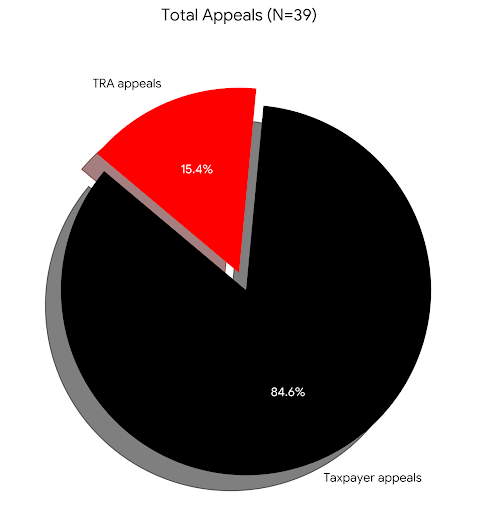

Appeals heard & determined

A total of 39 appeals were heard and determined by the Court of Appeal of Tanzania in the year 2025; 33 of these Appeals were lodged by Taxpayers constituting 84.6% of the appeals lodged and determined; TRA lodged 6 appeals constituting 15.4%.

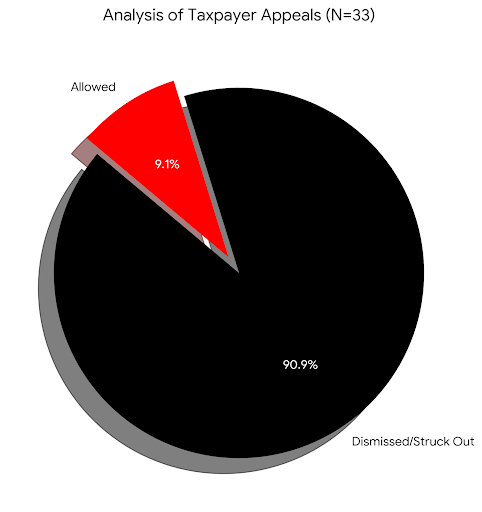

Taxpayer appeals success

Of the 33 appeals lodged by Taxpayers, 30 were either dismissed or struck out constituting nearly 91% of the appeals; 3 appeals constituting about 9% of the appeals were allowed in favour of the Taxpayer.

TRA appeals success

Of the 6 appeals lodged by the TRA, 3 were either dismissed or struck out constituting 50% of the appeals; 3 appeals constituting 50% of the appeals were allowed in favour of the TRA. TRA Appeals had a higher success rate at 50% compared to the Taxpayers success rate of 9.1%.

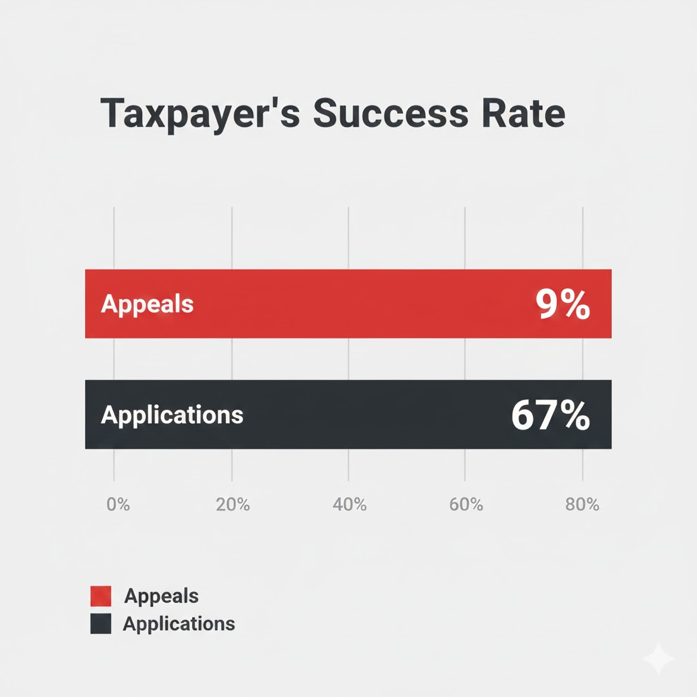

Taxpayer applications success

Of the 6 applications lodged by the Taxpayers, 4 were allowed in favour of the Taxpayer (about 67%) and 2 (33%) were dismissed. 5 of the 6 applications were for extension of time to file appeal; 1 of the 6 applications was for stay of execution, which was granted but with a condition to deposit a bank guarantee, as is mandatory under the Tanzania Court of Appeal Rules.

Tax payer success rate

Taxpayer’s applications had a higher chance of success at 67% compared to taxpayer success in appeals which stood at 9.1%. Taxpayer’s applications had a higher chance of success at 67% compared to taxpayer success in appeals which stood at 9.1%.

Snapshot

- 1/3 waiver decision by TRA remains to be final

- Issues of fact not appealable

- Submission of all documents at the objection stage critical

- Timing of filing appeals crucial

- Fraud to be strictly proved to be expensed

- For banks, interest in suspense on non-performing loans is taxable on an accrual basis

- Bad debts deductible only if reasonable recovery steps taken

- Tax statutes to be interpreted strictly

- Withholding tax payable on accrual basis

- Tax exemptions must be gazetted for legal force

- Denial of input tax claims with non-existent suppliers

- All grounds of appeal must be addressed

The Court of Appeal ruled that the Tax Revenue Appeals Board lacks jurisdiction to hear appeals arising from refusal or delay in granting a waiver of the one-third tax deposit, as these are not objection decisions. It reaffirmed the Pan African Energy precedent and held that a delayed decision does not amount to an omission under section 53(1) of the Tax Administration Act. The appeal was dismissed with costs, and the TRA’s position was upheld.

The Court of Appeal upheld the disallowance of claimed fraud losses, holding that the appellant failed to strictly prove employee fraud to justify deductions under section 39(a) of the Income Tax Act, hence requiring a higher degree of ‘probability’ than in ordinary civil cases. It found that invoices, bank statements, and cheques without police reports or effective recovery actions did not meet the required standard of proof for fraud. The appeal was dismissed with costs, affirming the Tribunal’s decision in favour of the TRA.

The Court of Appeal struck out the appeal for being time barred, holding that it was supported by an invalid certificate of delay. It found that the certificate wrongly excluded time up to the date of receipt of proceedings instead of the date when the Registrar notified the Appellant that the documents were ready for collection, contrary to Rule 90 of the Tanzania Court of Appeal Rules. As a result, the appeal was struck out with no order as to costs for being incompetent.

The Court of Appeal held that the twelve-month duty remission period applies to importation and not to the usage of industrial sugar. It found no legal basis for the TRA to reassess duties based on assumptions where the law is silent on consumption timelines. TRA’s appeal was dismissed with costs in favour of Coca Cola Kwanza Limited.

The Court of Appeal partly allowed the appeal, holding that the TRA was not justified in demanding VAT records beyond the five-year statutory retention period under section 25(2) of the VAT Act. It found that while reassessment for the years 2009–2013 was unlawful, the appellant failed to discharge the burden of proof for the years 2014–2016, justifying partial additional assessments. The appeal succeeded in part, with reassessments limited accordingly and no order as to costs.

The Court of Appeal held that interest in suspense on non-performing loans is taxable on an accrual basis under the Income Tax Act, 2004 despite the fact that the said Income Tax Act requires BOT Regulations, which suggest a cash basis for financial reporting, to apply. It also confirmed that bad debts are deductible only if all reasonable recovery steps were taken and the debt is proven uncollectable. The Court held that the Appellant failed to meet these requirements. The appeal was dismissed with costs, and the TRA’s assessments were upheld.

The appeal questioned whether all properties of a full-time school are tax-exempt under section 7(1)(g) of the Local Government Authorities (Rating) Act, Cap. 289. The Court held that the Tribunal wrongly expanded the exemption in favour of the taxpayer by misinterpreting the law and relying on expert evidence. Court relied on strict interpretation of tax statutes to avoid implied meanings and hence allowed the appeal, ruling that only sports-related properties are exempt.

Mobisol UK Limited’s solar TVs and radios were claimed as tax-exempt imports, but the Court ruled that they only consume, not generate, solar power. The Court also rejected arguments on estoppel, VAT ‘module’ status, and single supply, holding that had the legislators wanted to exempt solar TVs and solar radios, they would not have concealed them in the term ‘module’, they would have listed them as they did for solar panels and other items. All appeal grounds were dismissed, and the taxpayer’s items remain taxable.

Letshego Tanzania Limited filed its estimated tax return late for 2015, prompting the TRA to impose a penalty under section 98(1)(d) of the Income Tax Act. The company argued that the penalty should be based on quarterly instalments under section 98(1)(e), but the Board and Tribunal upheld the TRA’s calculation on total annual tax. The Court of Appeal dismissed the appeal, ruling the penalty was correctly imposed on the full annual tax, not just instalments.

Vodacom Tanzania delayed paying interest on loans, causing late withholding tax payment. The lower Courts (the Board and Tribunal) ruled that tax is due only on actual payment. The Court of Appeal held that tax is payable on an accrual basis and interest applies for late payment. Appeal allowed in favour of TRA.

Mlimani Holdings’ appeal for withholding tax exemption failed because it did not secure the required Government Notice, and loans from related companies are not exempt. The Board and Tribunal upheld TRA’s assessment. On appeal, the Court of Appeal dismissed the appeal, with each party bearing its own costs.

The Court of Appeal of Tanzania ruled that TPC Limited must withhold tax on service fees paid to South African entities, as they are not business profits under Article 7 of the Tanzania–South Africa Double Taxation Agreement. The decision relied on the existing precedent which confirms that such fees are taxable in Tanzania. The appeal was dismissed with costs.

Geita Gold Mine Limited claimed a VAT refund in 2014 for imported services from 2009–2011, but TRA rejected it on the ground of time limitation. The Court of Appeal held that VAT returns or corrected returns do not qualify as other evidence under the VAT Act. Consequently, the Court dismissed the appeal on the basis that the claim was outside the one-year statutory limit.

Serengeti Breweries challenged a VAT tax assessment, claiming that distributor incentives reduced taxable supplies. The Court ruled that the incentives did not reduce supply value and thus the tax was valid. The appeal was dismissed.

Sunshare Investment appealed a tax assessment by the Tanzania Revenue Authority, claiming that certain import invoices were cancelled and CIF values were miscalculated. The Court held that the appeal raised factual disputes rather than pure questions of law, which are required under the Tax Revenue Appeals Act. Consequently, the Court sustained the preliminary objection and struck out the appeal.

Williamson Diamonds Limited appealed TRA’s tax adjustments for 2013–2015, challenging disallowed expenses, asset reclassifications, and undercharged fuel sales. The Court of Appeal held that most issues involved factual findings, over which it has no jurisdiction, and found that selling fuel below cost justified TRA’s adjustments. Consequently, the appeal was dismissed with costs, upholding the decisions of the Board and Tribunal.

The Court of Appeal granted Tanzania Health Promotion Support a stay of execution of the tax payment of TZS 1.66 billion pending appeal. The Court ruled that the respondent’s letter was a valid notice, substantial loss was shown, and that the applicant’s security undertaking was sufficient. It held further that the stay is conditional on providing a bank guarantee within 60 days.

The Court of Appeal dismissed TRA’s appeal, ruling that security services are not taxable under the 2013 Practice Note. It upheld that Coca-Cola proved the withholding tax on early 2013 consultancy fees was excessive. TRA’s appeal failed with no costs awarded.

The Court of Appeal dismissed TPC Limited’s appeal, ruling that it failed to account for VAT on insurance compensation. The tax authorities correctly applied the law, including rejecting the company’s input tax claim. Each party was ordered to bear its own costs.

JCDecaux Tanzania Ltd’s VAT objection was not admitted because it failed to pay one-third of the assessed tax, as required by law. The company’s appeals to the TRAB and TRAT were, therefore, incompetent since no objection decision existed. The Court of Appeal nullified and quashed the TRAB and TRAT proceedings, striking out the appeal.

The Court of Appeal dismissed Jack’s (Tanzania) Ltd’s appeal, ruling that the VAT transactions were not genuine and the TRA correctly denied input tax claims. It held that transactions with non-existent suppliers are invalid, and the Tax Administration Act allowed the Commissioner to disregard them. All the appellant’s grounds of appeal were rejected, and the appeal was dismissed with costs.

The Court of Appeal quashed and set aside the Tribunal’s decision in favour of the Commissioner, ruling that the Tribunal failed to address GA Insurance Tanzania Limited’s grounds of appeal. The case was remitted for a fresh judgment before a different panel, based on the existing written submissions. No order as to costs was made.

Geita Gold Mining Limited’s application for extension of time to seek review of the 2020 Court of Appeal judgment was dismissed. The Court held that the applicant failed to account for the nearly four-year delay and that the alleged errors were ordinary mistakes, not obvious illegality. The application was dismissed with costs.

The Court granted Eristic an extension to file its appeal due to arguable legal errors in the Tribunal’s decision and the Managing Director’s illness which partly justified the delay. The Court allowed the application for extension of time by the taxpayer.

The Court granted Zanzibar Telecom an extension to file a notice of appeal due to procedural delays beyond its control. The alleged irregularity argued by the TRA that the assessment exceeded the time allowed by law was rejected for not being properly pleaded.

The Court of Appeal granted Tanzania Breweries extra time to file its appeal due to online system issues and Court unavailability. The delay was not the applicant’s fault and the Court ordered that the record must be filed within 14 days.

The Court upheld the excise duty and interest, ruling the Appellant’s offset and claims were invalid due to lack of documentation. The appeal was dismissed.

TANESCO’s request for more time to appeal was denied. The Court ruled that the claimed illegality was not clear and TANESCO acted negligently. No extension or costs were granted.

Tanga Cement’s appeal against withholding tax on payments to South African entities and interest was dismissed. The Court ruled that the payments were taxable under the DTA and investor exemptions required a Government Notice. The Tribunal’s decision was upheld with costs.

The Court of Appeal dismissed Mwenga Hydro’s appeal, ruling that the REA grant was a taxable subsidy for electricity connections, not a capital injection. The Tribunal properly evaluated the evidence, and the appellant was afforded a fair hearing. Factual disputes were outside the Court’s jurisdiction.

The Court of Appeal dismissed Tanga Cement’s appeal, ruling that the Board wrongly admitted documents not submitted during the objection stage. Evidence must be provided at the objection stage, and fresh evidence needs the Board’s consent. The Tribunal’s decision was upheld.

The Court of Appeal dismissed Geita Gold Mining’s appeal, ruling that VAT relief is not automatic and imported services must be reported in VAT returns. Failure to do so justified the additional assessment. The appeal was dismissed with costs.

The Court of Appeal dismissed SGS Tanzania’s appeal, holding that the company failed to show good cause for a delay in filing its tax appeal. The delay was due to the appellant’s inaction, not a technical issue. The Tribunal’s decision denying the extension was upheld.

The Court of Appeal dismissed Dangote Cement’s appeal, ruling that the Tribunal correctly disallowed 2015 fixed asset expenses claimed in 2016 under section 11(2) of the Income Tax Act. Section 11(2) was not a new issue, and section 21 on accounting was irrelevant. The appeal failed with costs.

The Court of Appeal ruled that TRA was correct to tax the 99.9% share transfer in Village Supermarket Limited as a change in underlying ownership. The Board and Tribunal had wrongly found no change. The transfer triggered deemed realization of assets, justifying payment of tax.

The Court of Appeal dismissed Coffee Exporters Limited’s appeal, ruling that its transactions with the foreign company were properly treated as controlled under Tanzania’s tax law. The appellant’s reliance on the OECD definition and unadmitted contracts was rejected. The appeal was dismissed.

SEACOM’s appeal against TRA’s tax on deemed intercompany interest was dismissed. The Court upheld TRA’s authority under tax and transfer pricing laws. The appeal failed with costs.

Tanga Cement’s appeal against TRA’s VAT assessment for 2015–2018 was dismissed. The Court held that the Tribunal correctly ruled the disputed invoices irrelevant and that the appeal raised no pure legal issues. Consequently, the appeal lacked merit, and costs were awarded to TRA.

The Court dismissed Lea Associates’ appeal, ruling that the Tribunal was correct in granting TRA’s extension to file an appeal based on assertions of illegality.

The Court of Appeal dismissed Tanga Cement’s appeal, ruling that its tax exemption was invalid due to lack of Cabinet approval. Interest on late tax payments was correctly imposed.

The Court of Appeal ruled that the appeal it raised factual not legal issues and hence outside its jurisdiction. The appellant’s claims on withholding tax required reviewing evidence, which fell outside the Court’s jurisdiction. The appeal was dismissed with costs.

The Court of Appeal struck out IBM Tanzania Limited’s appeal, holding that it was time-barred. The appellant failed to serve the required letter requesting appeal documents on the respondent within 30 days of the impugned decision, a mandatory requirement even before the 2024 amendments.

Mhingara Bureau de Change appealed the Tribunal’s decision that upheld the Board’s refusal to award her costs. The Court of Appeal held that a successful party cannot be denied costs without reasons and the Tribunal erred by failing to provide them. The appeal was partly allowed, and the appellant was awarded costs for the appeal.

The Court of Appeal upheld the Tribunal’s decision, ruling that Aggreko International Projects Limited failed to provide sufficient evidence that its head office costs were wholly and exclusively incurred in Tanzania, and hence they were not deductible under section 11(2) of the Income Tax Act. Consequently, the appeal was dismissed with costs.

The Court of Appeal dismissed the TRA’s appeal, by holding that the TRAT rightly refused extra time due to weak medical evidence and lack of diligence. Alleged errors and illegality were unproven.